US Cash Management Services Market Growth Trends & Future Outlook 2030

Future US Cash Management Services Market: Key Dynamics, Size & Share Analysis

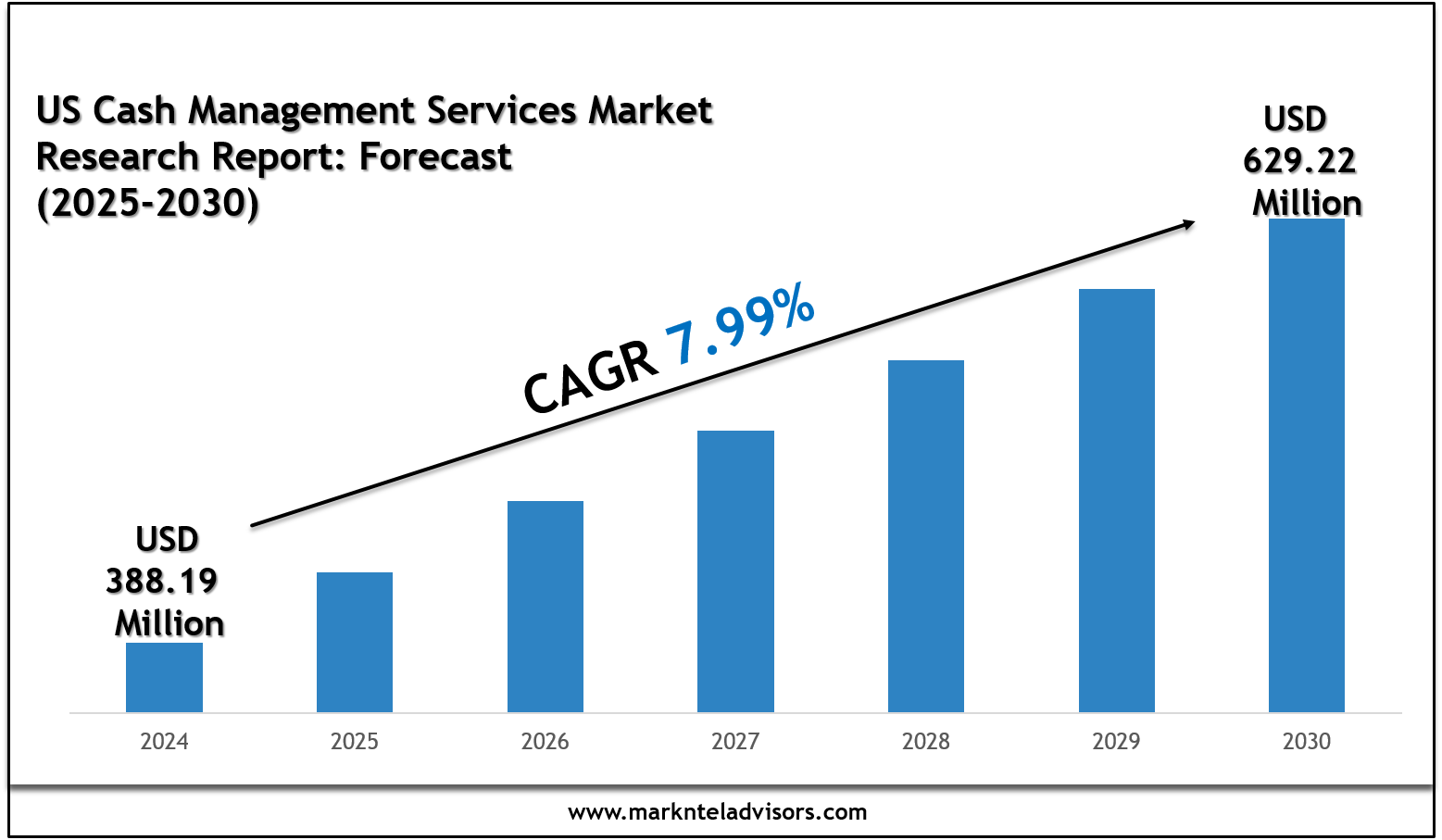

The US Cash Management Services Market size was valued at around USD 388.19 million in 2024 and is projected to reach USD 629.22 million in 2030. Along with this, the market is estimated to grow at a CAGR of around 7.99% during the forecast period, i.e., 2025-30. The cash management services industry has attained substantial growth due to factors such as the rising number of Automated Teller Machines, growing crime incidents at ATM premises, and high demand for cash. In the US, the number of machines is expanding, owing to continuous demand for cash accessibility. As per the ATM Industry Association, in 2021, the figure was observed at around 499,000 units, which increased to 520,000 in the year 2022. This surge in numbers is enhancing the adoption of cash management services such as hardware and software maintenance and upgrades, and cash management, among others.

Top Challenges Impacting the US Cash Management Services Market Growth

Rising Fraud and Cyber Attacks in ATMs – Fraud and Cyberattacks are common everywhere in the world, including in the US. Nowadays, cyber attackers are installing hidden devices in ATM card readers, leading to the theft of cash from ATMs. They are also injecting malicious software into the ATM's operating system through physical access or remotely via the internet. The attackers then forced the ATM to dispense large amounts of cash, causing the machine to release funds without validation. Additionally, jackpotting has been gaining more attention in recent years. Attackers are compromising ATMs in a coordinated fashion by using malware. Moreover, the incidence of physical attacks is also rising in the country, due to which the Cash Management Services Market might be hindered in the coming years.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2026 to 2032, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Unlock exclusive insights into the US Cash Management Services– request your free sample PDF now and explore key trends, growth drivers, and competitive strategies shaping the industry- https://www.marknteladvisors.com/query/request-sample/us-cash-management-services-market.html

Understanding the Core Segments in the US Cash Management Services Market

US Cash Management Services Market Size, Share & Industry Trends Analysis- By Type (ATM/CDM Hardware and Software Solutions, Managed Services, 24/7 incident and helpdesk Management, ATM Monitoring, ATM Site Identification and Preparation, Cash Management, Reconciliation and cash optimization) By End User (Banks, Independent ATM Deployers)

Who Dominates the US Cash Management Services Market Insights on Key Industry Players?

Companies are strengthening their presence in the US Cash Management Services market by adopting strategies such as forming strategic alliances, leveraging AI, entering partnerships, pursuing mergers and acquisitions, expanding into new regions, and introducing innovative products and services.

- Brink’s Company

- Loomis Armored US, LLC

- Allied Universal

- NCR Atleos

- CSC Global

- Black Rock (Cachematrix Software Solutions, LLC)

- Diebold Nixdorf

- Firstnbtc (First National Bank and Trust Company)

- FCTI Inc.

- Banco Bilbao Vizcaya Argentina, S.A

- Others

Tap into future trends and opportunities shaping the US Cash Management Services Market View Full report: - https://www.marknteladvisors.com/research-library/us-cash-management-services-market.html

Why Choose This MarkNtel Advisors Research Report

- Comprehensive Insights – Offers a 360° view of the market, combining qualitative and quantitative analysis for a deep understanding of trends, drivers, challenges, and opportunities.

- Reliable Data Sources – Data is gathered through verified primary and secondary sources, ensuring accuracy and credibility.

- Actionable Forecasts – Advanced predictive modeling and time-series analysis provide practical insights to guide strategic decisions and business planning.

- Expert Analysis – Insights from industry experts help interpret complex market dynamics, delivering clarity beyond the numbers.

- Customized & Strategic Reporting – The report includes detailed charts, graphs, and strategic recommendations tailored to support business growth and investment decisions.

- Trusted Methodology – Built on rigorous research principles, including precise sampling, data validation, and forecasting techniques, reflecting the trust businesses place in MarkNtel Advisors.

"This report equips decision-makers with actionable intelligence, enabling them to navigate market complexities with confidence and foresight."

Gain exclusive access to our comprehensive insights on the Future of US Cash Management Services Market. With tailored licensing options, including Mini Report Pack, Excel Data Pack, Single User, Multiuser, and Enterprise Packs, our research empowers organizations to navigate dynamic market trends effectively.

Select a License That Matches Your Business Requirements with Instant Offer - https://www.marknteladvisors.com/pricing/us-cash-management-services-market.html

About us:

MarkNtel Advisors is a prominent market research and consulting firm delivering data-driven insights across the financial technology (FinTech) ecosystem, including omnichannel banking, digital payments, and core banking infrastructure. We analyze digital transformation trends and regulatory frameworks to help financial institutions and investors build future-ready strategies. Through Competitive Intelligence, we provide clients with benchmarking tools and strategic assessments that foster innovation, compliance, and market leadership in the evolving world of financial technology.

MarkNtel Advisors is a leading Industry Research Report Firm and Market Research Company delivering comprehensive intelligence across the financial technology (FinTech) ecosystem, including omnichannel platforms, digital banking, and core banking systems. Our portfolio of Customized Market Research Reports and Syndicated Research Reports provides actionable insights into innovation trends, regulatory frameworks, and investment flows at global, regional, and country levels. Leveraging detailed Market Research and Export and Import Data, we help institutions and investors identify profitable opportunities and manage risk effectively. Our analysts conduct in-depth Business Analysis and Financial Services assessments that quantify Revenue Impact and forecast market potential with precision. Supported by advanced Consulting Services, MarkNtel Advisors empowers FinTech stakeholders to navigate digital transformation, enhance competitiveness, and build resilient financial ecosystems worldwide.

Other Reports:

- https://johnryanwork0.wixsite.com/future-trends-market/post/future-trends-of-industrial-valves-market-in-south-korea

- https://futuremarketanalysiss.blogspot.com/2025/10/hot-sauce-market-germany.html.html

- https://medium.com/@johnryanwork0/nanotech-trends-reshaping-saudi-synthetic-lubricants-sector-27953282ba61

Reach Us:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

We’re always open to sharing insights, exploring ideas. Follow us to stay updated on the latest news and industry trends.