Data as a Service (DaaS) Market Trends, Share & Forecast to 2035

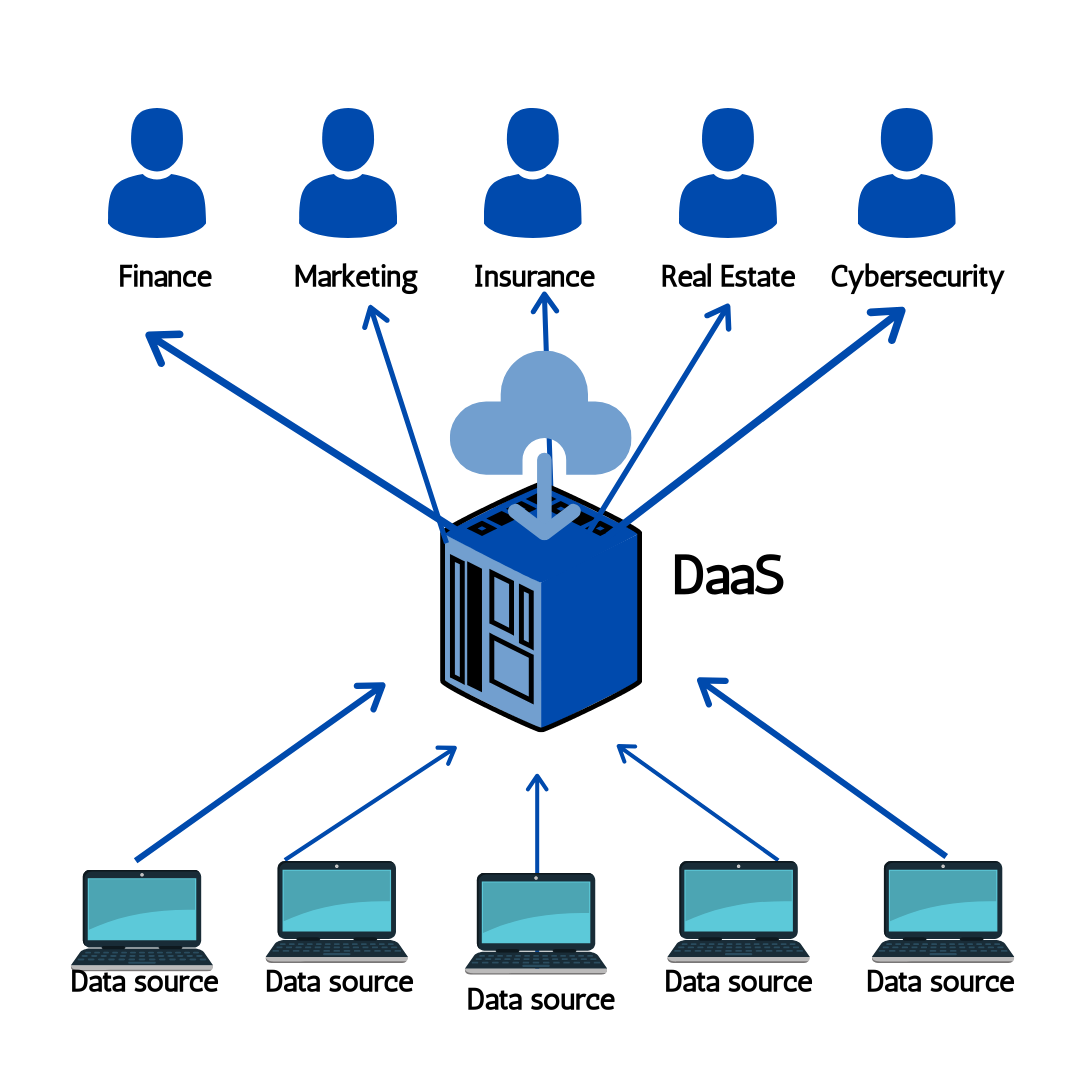

The global Data as a Service (DaaS) market is in a state of hyper-growth, but this expansion is not a uniform wave; a strategic analysis of the Data as a Service (DaaS) Market Growth Share by Company reveals a significant shift in where new revenue and value are being captured. The fastest-growing segments are those driven by cloud-native delivery models, API-first products, and the immense network effects of data marketplaces. The companies that have built their businesses around these modern paradigms are capturing a disproportionate share of the market's growth, while traditional data providers reliant on legacy delivery methods are facing increasing pressure. This dynamic highlights a fundamental transformation in how data is consumed by enterprises. The Data as a Service (DaaS) Market size is projected to grow USD 75.2 Billion by 2035, exhibiting a CAGR of 17.23% during the forecast period 2025-2035. Understanding this allocation of growth is key, as it underscores the ascendancy of scalable, on-demand, and easily integratable data services over static, bulk data sales, with the cloud hyperscalers and agile startups leading the charge.

A massive portion of the market's growth share is being captured by the major public cloud providers through their data marketplace offerings. Platforms like AWS Data Exchange and Google Cloud's Datashare have become powerful engines for growth by creating a two-sided network. They provide a seamless, secure, and scalable platform for hundreds of third-party data providers to list and sell their datasets, and they provide their millions of cloud customers with an easy, integrated way to discover and subscribe to this data. The cloud providers capture a share of this growth by taking a percentage of every transaction that occurs on their marketplace. Their growth is driven by a powerful flywheel effect: more data providers on the platform attract more data consumers, which in turn incentivizes more data providers to join. This strategy allows the hyperscalers to capture a significant share of the overall DaaS market's growth without having to own or create the data themselves, positioning them as the indispensable "digital logistics" layer for the entire data economy. Their growth is a function of the total volume of data being transacted across their entire ecosystem.

While the hyperscalers capture growth through their marketplaces, another significant share of the expansion is being won by specialized, API-first DaaS startups that are focused on high-value, niche datasets. These companies are experiencing explosive growth by identifying a specific type of data that is hard to acquire but highly valuable—such as real-time shipping logistics data, satellite imagery analysis, or B2B software buying-intent signals—and making it available through a simple, developer-friendly API. Their growth is not based on breadth, but on the unique and actionable nature of their data. In contrast, the growth of traditional data brokers is more modest and often defensive. They are capturing growth primarily by successfully transitioning their existing customer base from legacy delivery methods (like file transfers) to their new cloud-based, API-driven platforms. While their incumbency and proprietary datasets give them a stable foundation, they are not capturing the same rate of net-new customer growth as the more agile, cloud-native players. The future of growth share in the DaaS market clearly belongs to those who can deliver valuable data in the most frictionless, scalable, and developer-friendly way possible.

Top Trending Reports -