Digital Remittance Market Industry Statistics: Growth, Share, Value, Insights, and Trends

"Executive Summary Digital Remittance Market Size and Share: Global Industry Snapshot

CAGR Value

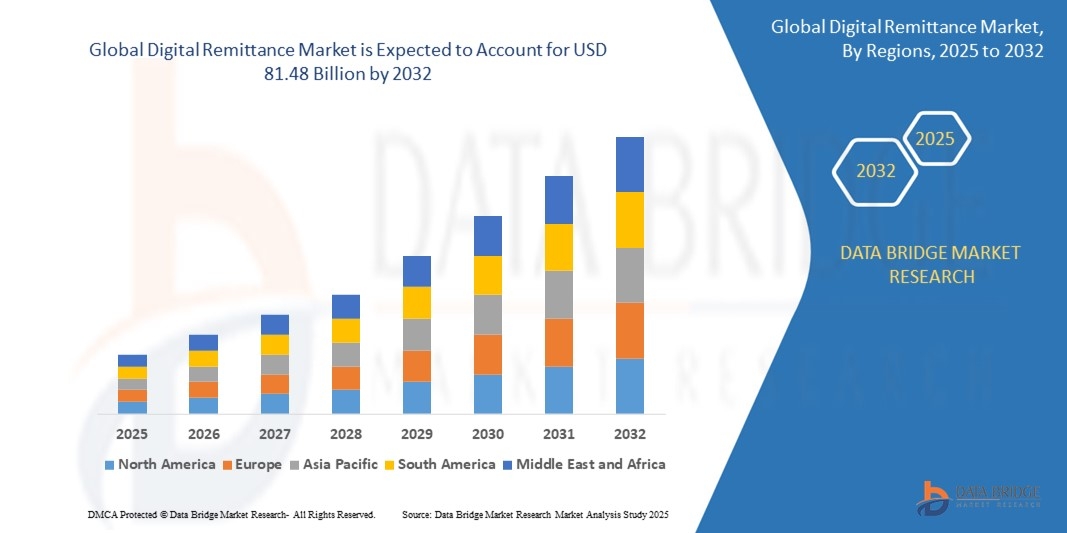

The global digital remittance market was valued at USD 25.20 billion in 2024 and is expected to reach USD 81.48 billion by 2032. During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.80%, primarily driven by rapid penetration of smartphones and internet services.

For an actionable market insight and lucrative business strategies, a faultless market research report has to be there. The credible Digital Remittance Market report covers all the studies and estimations that are involved in the method of standard market research analysis. This market report endows with a profound overview of product specification, technology, product type and production analysis by considering most important factors such as revenue, cost, and gross margin. Digital Remittance Market report is a window to the Digital Remittance Market industry which defines properly what market definition, classifications, applications, engagements and market trends are.

An all-inclusive Digital Remittance Market research report comprises of different industry verticals such as company profile, contact details of manufacturer, product specifications, geographical scope, production value, market structures, recent developments, revenue analysis, market shares and possible sales volume of the company. The market insights acquired through this market research report facilitates more defined understanding of the market landscape, issues that may interrupt in the future, and ways to position specific brand brilliantly. A market overview is given in terms of drivers, restraints, opportunities and challenges where each of this parameter is studied scrupulously. Digital Remittance Market report works as a superb guide for actionable ideas, enhanced decision-making and better business strategies.

Stay informed with our latest Digital Remittance Market research covering strategies, innovations, and forecasts. Download full report: https://www.databridgemarketresearch.com/reports/global-digital-remittance-market

Digital Remittance Market Trends & Analysis

Segments

- By Type: The digital remittance market can be segmented into inward digital remittance and outward digital remittance. Inward digital remittance refers to the funds transferred into a country, usually by migrant workers sending money back to their home country. Outward digital remittance, on the other hand, involves funds being sent out of a country by residents to recipients in another country.

- By Channel: This segment includes segments like digital platforms, banks, and money transfer operators. Digital platforms refer to online platforms that facilitate digital remittances. Banks play a significant role in facilitating digital remittances through their online banking services. Money transfer operators are entities that specialize in transferring funds internationally.

- By End-User: The market can also be segmented by end-user, with categories such as personal and business users. Personal users consist of individuals sending money to family and friends, while business users include companies making international payments to suppliers or employees.

- By Region: Geographically, the digital remittance market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique market dynamics, regulatory environment, and consumer behavior that influence the digital remittance landscape.

Market Players

- PayPal Holdings, Inc.: An American company operating a worldwide online payments system that supports online money transfers.

- Amazon Payments, Inc.: A subsidiary of Amazon providing online payment processing solutions for merchants and shoppers.

- TransferWise Ltd.: A UK-based money transfer service that enables consumers to send money internationally at a low cost.

- Remitly, Inc.: A digital remittance company headquartered in the United States that offers online money transfer services.

- WorldRemit Ltd.: A digital remittance company founded in London, enabling users to send money to more than 150 countries worldwide.

- Western Union Holdings, Inc.: A global leader in cross-border money transfers, providing digital and retail payment services.

- MoneyGram International Inc.: An American money transfer company offering digital remittance services along with its traditional money transfer services.

The global digital remittance market is a dynamic and fast-growing industry driven by technological advancements, changing consumer preferences, and the increasing adoption of digital payment solutions. As the world becomes more interconnected, the demand for fast, secure, and cost-effective remittance services continues to rise. The key players in the market are continuously innovating to provide convenient and efficient digital remittance solutions to their customers. With the increasing penetration of smartphones and internet connectivity, digital remittance services are expected to witness significant growth in the coming years.

The global digital remittance market is witnessing a transformative shift, fueled by the growing need for efficient and convenient cross-border money transfer solutions. One emerging trend worth noting is the increasing focus on financial inclusion, where digital remittance services are playing a crucial role in providing access to financial services for unbanked populations. By leveraging mobile technology and innovative payment platforms, market players are expanding their reach and enabling individuals in underserved regions to participate in the digital economy.

Moreover, the market is witnessing a surge in strategic partnerships and collaborations among key players to enhance their service offerings and geographic presence. By forming alliances with fintech companies, banks, and mobile wallet providers, digital remittance service providers are able to tap into new customer segments and streamline the remittance process for users. These collaborations also enable players to leverage each other's strengths, such as technology infrastructure, regulatory compliance, and customer base, to achieve mutual growth and success in the competitive market landscape.

Another notable trend in the digital remittance market is the increasing adoption of blockchain technology to enhance the security, speed, and transparency of cross-border transactions. By leveraging blockchain-based solutions, remittance service providers can offer real-time settlement, lower transaction costs, and improved traceability of funds, addressing key pain points for customers sending money internationally. Blockchain also enables secure data encryption and authentication, reducing the risk of fraud and enhancing trust among users in the digital remittance ecosystem.

Furthermore, regulatory developments and compliance requirements are shaping the digital remittance market, with government bodies and financial authorities implementing stringent regulations to combat money laundering, fraud, and terrorist financing. Market players are investing in robust compliance measures, including Know Your Customer (KYC) procedures, anti-money laundering (AML) checks, and transaction monitoring systems, to ensure adherence to regulatory standards and maintain trust with regulators and customers alike.

Overall, the digital remittance market is poised for continued growth and innovation, driven by evolving consumer preferences, technological advancements, and strategic partnerships. As the demand for fast, secure, and cost-effective cross-border money transfer solutions continues to rise, market players will need to stay agile, customer-centric, and compliant with regulatory requirements to capitalize on the opportunities presented by the dynamic digital remittance landscape.The global digital remittance market is experiencing a paradigm shift driven by technological innovations, changing consumer behaviors, and regulatory developments. One significant trend shaping the industry is the increasing emphasis on financial inclusion, where digital remittance services are serving as a crucial bridge to provide access to financial services for unbanked populations. By leveraging mobile technology and innovative payment platforms, market players are extending their services to underserved regions, thereby facilitating participation in the digital economy.

Moreover, strategic partnerships and collaborations within the market are on the rise, enabling key players to augment their service offerings and expand their geographic footprint. Through alliances with fintech firms, banks, and mobile wallet providers, digital remittance service providers can access new customer segments, enhance the remittance process, and leverage synergies in technology infrastructure and customer bases to drive mutual growth and success in the fiercely competitive market environment.

Another notable trend shaping the digital remittance market is the increasing adoption of blockchain technology to enhance transaction security, speed, and transparency. By embracing blockchain-based solutions, remittance service providers can deliver real-time settlements, reduce transaction costs, and enhance the traceability of funds, addressing critical pain points for individuals engaging in international money transfers. Blockchain's secure data encryption and authentication features also bolster fraud prevention measures and foster trust among users within the digital remittance ecosystem.

Furthermore, regulatory dynamics and compliance imperatives are exerting a significant influence on the digital remittance landscape. Government entities and financial regulators are imposing stringent guidelines to combat issues like money laundering, fraud, and illicit financing activities. To adhere to regulatory standards and maintain credibility with regulators and customers, market participants are investing in robust compliance frameworks encompassing mechanisms such as Know Your Customer (KYC) protocols, anti-money laundering (AML) checks, and transaction monitoring systems.

In conclusion, the digital remittance market is poised for sustained expansion and innovation, underpinned by shifting consumer preferences, technological advancements, and strategic partnerships. As the demand for efficient, secure, and cost-effective cross-border money transfer solutions continues to escalate, it becomes imperative for market players to embrace agility, customer-centricity, and regulatory compliance to capitalize on the opportunities arising within the dynamic digital remittance landscape.

Learn about the company’s position within the industry

https://www.databridgemarketresearch.com/reports/global-digital-remittance-market/companies

Digital Remittance Market Overview: Strategic Questions for Analysis

- Which technologies are enhancing customer experience?

- How do climate conditions affect product demand?

- What is the return rate of products in the Digital Remittance Market?

- How are companies building brand awareness?

- What role do trade shows play in this Digital Remittance Market?

- How has the B2B segment evolved?

- What partnerships exist with logistics providers?

- Which region has the highest customer lifetime value?

- How do brands manage customer feedback?

- What are the top loyalty-building tactics?

- What marketing channels have the highest ROI?

- How is CSR (Corporate Social Responsibility) leveraged?

- What’s the conversion rate in digital campaigns?

- How are enterprises managing inventory?

Browse More Reports:

Global Tennis Equipment Market

Global Threat Detection Systems Market

Global Transarterial Chemoembolization (TACE) Market

Global Triphala Extracts Market

Global Vaccine Adjuvants Market

Global Voice Banking Market

Global Water Treatment Chemicals Market for Geothermal Power

Global Wearable Medical Devices Market

Global Weight Management Market

Global Wheat Germ Oil Market

North America Alkylation Market

Middle East and Africa Cell Culture Media Market

Middle East and Africa Collaborative Robot Market

Asia-Pacific Corrugated Box Market

Asia-Pacific Computed Tomography (CT) Simulators Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"