Tax Tech Market Growth Drivers: Share, Value, Size, Insights, and Trends

"Competitive Analysis of Executive Summary Tax Tech Market Size and Share

CAGR Value

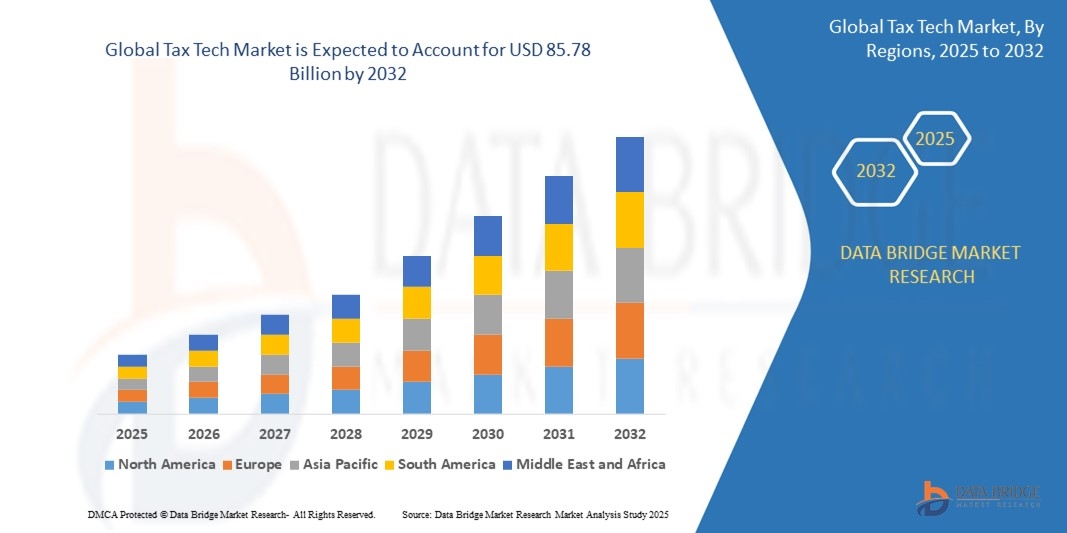

The global tax tech market size was valued at USD 34.4 billion in 2024 and is expected to reach USD 85.78 billion by 2032, at a CAGR of 12.10% during the forecast period.

To stand apart from the competition, a careful idea about the competitive landscape, their product range, their strategies, and future prospects is very important. Tax Tech Market research report contains a comprehensive study of the product specifications, revenue, cost, price, gross capacity and production. Market report is a verified and consistent source of information that puts forth a telescopic view of the existing market trends, emerging products, situations, and opportunities. It provides noteworthy data, current market trends, future events, market environment, technological innovation, approaching technologies and the technical progress in the relevant industry.

Staying informed about the trends and opportunities in the industry is quite a time consuming process where Tax Tech Market report actually helps a lot. The major areas of market analysis such as market definition, market segmentation, competitive analysis and research methodology are studied very carefully and precisely in the whole report. Various steps are used while generating this report by taking the inputs from a specialized team of researchers, analysts and forecasters. An excellent Tax Tech Market research report can be generated only with the leading attributes such as highest level of spirit, practical solutions, committed research and analysis, innovation, talent solutions, integrated approaches, most up-to-date technology and dedication.

Get the edge in the Tax Tech Market—growth insights and strategies available in the full report:

https://www.databridgemarketresearch.com/reports/global-tax-tech-market

Tax Tech Market Landscape Overview

Segments

- By Offering: Software, Services

- By Tax Type: Direct Tax, Indirect Tax

- By Deployment Mode: Cloud, On-Premises

- By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

- By Vertical: Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT and Telecommunications, Government, Others

The global tax tech market is segmented on the basis of offering, tax type, deployment mode, organization size, and vertical. In terms of offering, the market is divided into software and services. The software segment is expected to witness significant growth due to the increasing demand for automated tax compliance solutions. By tax type, the market is categorized into direct tax and indirect tax. The direct tax segment is projected to hold a larger market share as organizations prioritize efficient management of their direct tax obligations. Based on deployment mode, the market is segmented into cloud and on-premises. The cloud segment is anticipated to experience rapid growth with the rising adoption of cloud-based tax technology solutions. In relation to organization size, the market caters to large enterprises and small and medium-sized enterprises (SMEs). Large enterprises dominate the market due to their higher investment capacity in advanced tax technologies. Lastly, in terms of vertical, the market serves various industries including banking, financial services, and insurance (BFSI), healthcare and life sciences, retail and e-commerce, IT and telecommunications, government, and others.

Market Players

- Avalara, Inc.

- Intuit Inc.

- Thomson Reuters

- H&R Block

- Wolters Kluwer

- Blucora, Inc.

- Vertex, Inc.

- Xero Limited

- SOVOS Compliance

- TaxSlayer LLC

Key market players in the global tax tech market include Avalara, Inc., Intuit Inc., Thomson Reuters, H&R Block, Wolters Kluwer, Blucora, Inc., Vertex, Inc., Xero Limited, SOVOS Compliance, and TaxSlayer LLC. These companies are focusing on strategic initiatives such as partnerships, acquisitions, and product innovations to enhance their market presence and cater to the increasing demand for advanced tax technology solutions. With the continuous evolution of tax regulations and the growing complexity of tax processes, these market players are at the forefront of providing cutting-edge technologies to streamline tax compliance and reporting for businesses worldwide.

The global tax technology market continues to witness significant growth driven by the increasing demand for automated tax compliance solutions across various industries. As businesses strive to manage their tax obligations efficiently, the adoption of advanced tax technology solutions is becoming crucial. Market players are actively focusing on expanding their offerings to cater to the evolving needs of organizations worldwide. Partnerships and acquisitions are common strategies employed by key players to enhance their market presence and solidify their position in the competitive landscape. Additionally, continuous product innovations are aimed at providing cutting-edge technologies to streamline tax compliance and reporting processes, offering businesses improved efficiency and accuracy in managing their tax requirements.

One key trend shaping the tax tech market is the shift towards cloud-based solutions. The cloud deployment mode is gaining traction due to its scalability, flexibility, and cost-effectiveness. With the rise of remote work and digital transformation initiatives, organizations are increasingly turning to cloud-based tax technology solutions to ensure seamless access to critical tax data and functionalities from anywhere. The cloud also provides enhanced security features, ensuring that sensitive tax information is protected from cyber threats and unauthorized access.

Another notable trend is the focus on vertical-specific solutions tailored to meet the unique tax challenges faced by different industries. Key players are developing industry-specific tax technology solutions to address the complexities and regulatory requirements specific to sectors such as BFSI, healthcare, retail, and government. By offering specialized solutions, companies are better equipped to address industry-specific tax compliance needs and provide targeted services that deliver maximum value to clients.

Moreover, the market is witnessing an increasing demand for integrated tax technology platforms that offer a comprehensive suite of tax compliance, reporting, and analytics tools. Businesses are looking for end-to-end solutions that streamline their entire tax lifecycle, from data collection and calculations to filing and reporting. Integrated platforms help organizations achieve greater efficiency in managing their tax processes, reduce manual errors, and enhance overall compliance with tax regulations.

In conclusion, the global tax technology market is undergoing rapid evolution driven by the changing tax landscape and the growing complexity of tax processes. Key market players are at the forefront of innovation, offering advanced solutions to meet the diverse needs of organizations across industries. With a focus on software, services, deployment modes, organization size, and vertical-specific offerings, the tax tech market is poised for continued growth as businesses seek to leverage technology to navigate the complexities of tax compliance and reporting effectively.The global tax tech market is witnessing robust growth propelled by the increasing demand for automated tax compliance solutions across various sectors. Businesses are increasingly recognizing the importance of efficient tax management in navigating the intricate regulatory landscape. Key players in the market, such as Avalara, Inc., Thomson Reuters, and Intuit Inc., are actively engaged in strategic initiatives like partnerships, acquisitions, and product innovations to strengthen their market presence and meet the rising demand for advanced tax technology solutions. These companies are at the forefront of offering cutting-edge technologies aimed at streamlining tax compliance and reporting processes for organizations worldwide.

One of the prominent trends shaping the tax tech market is the rapid adoption of cloud-based solutions. The shift towards cloud deployment is gaining momentum due to its scalability, flexibility, and cost-effectiveness. With the increasing prevalence of remote work and digitalization efforts, businesses are turning to cloud-based tax technology solutions to ensure seamless access to critical tax data from any location. Moreover, cloud technology provides enhanced security features, safeguarding sensitive tax information against cyber threats, and unauthorized access, thereby boosting its appeal among organizations seeking robust data protection measures.

Another significant trend in the tax tech market is the development of vertical-specific solutions tailored to address the unique tax challenges faced by different industries. Companies are focusing on creating industry-specific tax technology solutions to cater to the intricate regulatory requirements of sectors such as BFSI, healthcare, retail, and government. By offering specialized solutions, market players can effectively meet industry-specific tax compliance needs, providing targeted services that deliver maximum value to clients and strengthen their competitive position in the market.

Furthermore, there is a growing demand for integrated tax technology platforms that provide a comprehensive suite of tax compliance, reporting, and analytics tools. Businesses are increasingly seeking end-to-end solutions that streamline the entire tax lifecycle, enhancing efficiency, reducing manual errors, and ensuring compliance with tax regulations. Integrated platforms enable organizations to achieve greater precision in managing their tax processes, contributing to enhanced operational efficiency and regulatory compliance.

In conclusion, the global tax technology market is poised for continued growth driven by the evolving tax landscape and the escalating complexity of tax processes globally. Market players are at the forefront of innovation, offering advanced solutions tailored to the diverse needs of organizations across different industries. With a focus on software, services, deployment modes, organization size, and vertical-specific offerings, the tax tech market is set to witness significant expansion as businesses increasingly leverage technology to navigate the intricacies of tax compliance effectively.

Study the company’s hold in the market

https://www.databridgemarketresearch.com/reports/global-tax-tech-market/companies

Custom Question Framework for Global Tax Tech Market Reports

- How big is the Tax Tech Market as of the latest report?

- What is the growth projection for the Tax Tech Market over the forecast period?

- What are the different categories or segments examined?

- Which firms have a stronghold in the Tax Tech Market?

- What new product launches have emerged recently?

- What countries’ performance metrics are analyzed?

- What is the highest growth region in the current analysis?

- Which nation could take the top spot in the market landscape?

- Which area currently dominates the market by share?

- What country is likely to achieve peak growth by CAGR?

Browse More Reports:

Global Lab-Grown Organoids for Drug Testing Market

Global Laboratory Hoods and Enclosure Market

Global Lactobacillus Probiotic Ingredient for Animal Market

Global LAL Testing Market

Global Laparoscopic Devices Market

Global Laser Headlight Market

Global Laser Phosphor Display (LPD) Market

Global Lawn and Garden Equipment Market

Global LED Backlight Display Driver ICS Market

Global Light-Emitting Diode (LED) Materials Market

Global Leukotriene Inhibitors Market

Global LIDAR Drones Market

Global Light Emitting Diode (LED) Packaging Market

Global Liquid On Silicon (Lcos) Front Projection Market

Global Lithium-Ion Battery’s Electrolyte Solvent Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"