Global Travel Management Software Market Revenue and Competitive Landscape | 2035

Successfully entering the mature and highly competitive global Travel Management Software market requires a new company to have a sharply defined and well-executed strategy that can effectively differentiate it from a host of established, well-funded incumbents. Attempting to launch a generic, horizontal travel and expense platform to compete head-on with the likes of SAP Concur, Navan, or the major TMCs is a strategy with a very low probability of success due to their massive brand recognition, extensive supplier integrations, and deeply entrenched customer bases. Therefore, a careful analysis of viable Travel Management Software Market Entry Strategies reveals that the most promising paths for a new entrant are not about being a better version of the incumbents, but about being a completely different and superior solution for a specific, carefully chosen market segment. This requires a laser focus on either a specific industry vertical, a disruptive technological approach, or an underserved customer segment.

One of the most proven and effective entry strategies is that of deep vertical specialization. Instead of trying to be a one-size-fits-all solution for all types of corporate travel, a new entrant can focus exclusively on an industry with unique and complex travel needs. For example, a new company could build a platform specifically for the non-profit and humanitarian aid sector, with features for managing travel to remote and high-risk locations, tracking grant-funded travel, and ensuring a high level of duty of care. Another high-potential vertical is the production and entertainment industry, which has complex needs around managing travel for large crews, booking multi-person itineraries, and handling complex expense allocations. By becoming the undisputed expert in a specific vertical, a new entrant can build a strong brand, command premium pricing, and create a powerful competitive moat that the large, horizontal players cannot easily replicate. This deep domain expertise becomes the core of the company's value proposition.

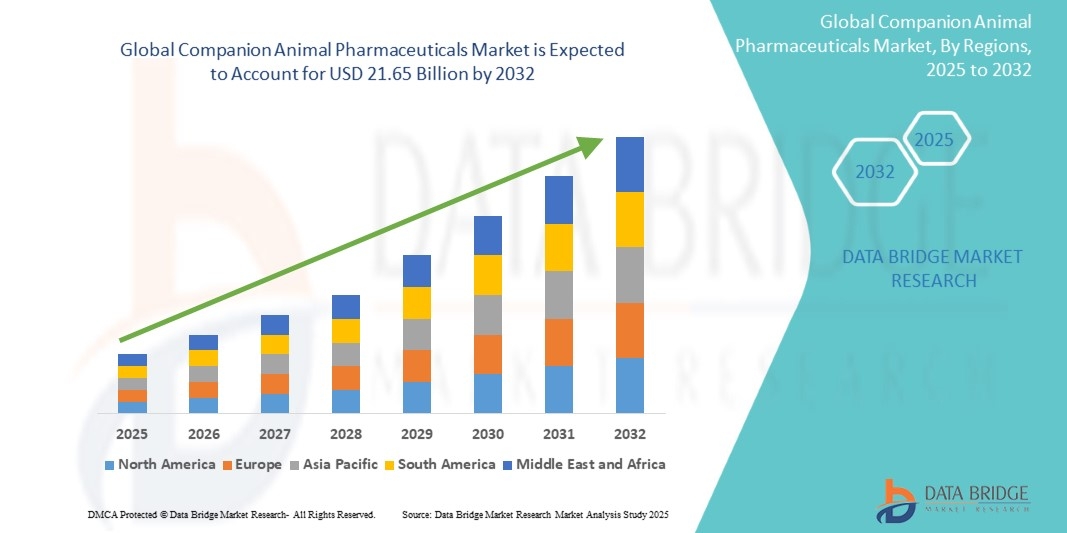

Another powerful entry strategy is to lead with a disruptive technology or a novel business model. A new entrant could build a platform that is AI-native from the ground up, using generative AI to create a truly conversational and personalized booking and support experience that is far superior to the chatbots of today. Another technological angle could be to focus on a breakthrough in sustainability, creating a platform that not only tracks carbon emissions but uses sophisticated algorithms to proactively recommend and incentivize lower-carbon travel options. A disruptive business model could also be a key differentiator. For example, a company could enter the market with a completely free booking platform that monetizes through other means, such as by taking a share of hotel commissions or selling anonymized data insights. The (Placeholder) Travel Management Software Market size is projected to grow to (Placeholder: e.g., USD 26.04 Billion) by 2035, exhibiting a CAGR of (Placeholder: e.g., 9.04%) during the forecast period 2025-2035. Ultimately, a successful entry is about creating a unique and compelling value proposition that makes the new company the only logical choice for a specific set of customers.

Top Trending Reports -

APAC Contact Center Analytics Market